philadelphia wage tax refund

2021 Income-based Wage Tax refund petition non-residents PDF. For 2020 and 2021 the Philadelphia Department of Revenue has created a COVID-EZ Refund Petition form.

9 Common Us Tax Forms And Their Purpose Infographic Income Tax Preparation Tax Forms Us Tax

2020 COVID EZ Phila CWT Refund Letter.

. The tax still went to Philly. Get Real Estate Tax relief. Percentage of time worked outside of Philadelphia.

The online forms for a city wage tax refund went live at the end of January. NBC10 Responds and Tracy Davidson have the details. Before COVID-19 companies withheld Philadelphia wage tax from paychecks automatically.

Youll need a letter from your employer or from payroll to accompany your refund request. Although paper versions of the 2021 online Wage Tax petitions are available we encourage you to use the online form. Refunds for taxes paid to local jurisdictions.

So you might think non-residents who worked from home during the. Without the offset of the Philly wage tax you will owe a lot to NJ and will probably have penalty and interest. WAGE TAX REFUND PETITION SALARYHOURLY EMPLOYEES Not to be used by Commissioned Employees 2020 Salary Wage Petition 02-05-2021 TAX YEAR 2020 I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my knowledge and.

Philadelphia residents can use this form to request a refund for Wage Tax amounts you paid if youre eligible for income-based reductions. Because the City of Philadelphia is expecting an extreme increase in the number of refund petitions for 2020 they have attempted to make the process easier. In general it also takes a long time for the Philadelphia Department of Revenue to refund wage tax payments.

Give Us Feedback. Open a safe and affordable bank account. Philadelphia Wage Tax Refund Petition Instructions.

How you can file for your city wage tax refund. Philadelphia city has launched a new online Philadelphia Tax Center which makes it easier to pay wage taxes but also to apply for a refund if you still work from your home outside the city. While Philadelphia residents are eligible for refunds of City Wage Tax if they paid tax to other local jurisdictions ie Wilmington Delaware we are going to focus on refunds for non-residents as the pandemic has changed how and where.

This applies to all nonresidents whose base of operations is the employers location in Philadelphia. NJ is just giving you credit for tax paid twice on the same income. The wage tax rate is set to drop from 384 to 379 for city workers and the median annual household income for Philadelphia is about 49k.

The city has approved about 32000 applications for 2020 thus far Lessard said compared with. Employees claiming a Philadelphia City Wage Tax Refund should complete only one of the following forms. Under this test a nonresident is exempt from the Wage Tax for the days.

Normally Philadelphia non-residents employed in the city can get a wage tax refund for days they worked outside of Philadelphia. This form could not be filed electronically. 2020 Philadelphia City Wage Tax Refunds.

Yo Philly help our commuters get city wage tax refund As of last year non-Philadelphia residents could apply online to. The letter signed and on company letterhead must include the dates you were required to work outside Philadelphia. Wed love to hear from you.

Erin Arvedlund tallied up the impact for The Philadelphia Inquirer. Visit Corporate Tax Compliance and Payroll. The 105 million that Philadelphia expects to repay nonresidents represents just 62 of the 159 billion in wage tax revenue the city collected in the last fiscal year.

Have recommendations or feedback. If you have trouble requesting a Wage Tax refund on the Philadelphia Tax Center please call 215 686-6600. A non-resident who works in Philadelphia and doesnt have the City Wage Tax withheld from your paycheck.

The Earnings Tax is a tax on salaries wages commissions and other compensation paid to a person who works or lives in Philadelphia. Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city. And those that live in the suburbs may be entitled to a wage.

2021 COVID EZ Request. Philadelphia wage tax refunds are delayed by about eight to ten weeks due to a surge in applications. Many employees have been working from home to help slow the spread of the coronavirus.

Appeal a water bill or water service decision. The tax has often been cited as a job killer but it raises so much money that the city cant easily replace it. With that household income youd pay 1886 per.

Eligibility for Wage Tax refunds - For nonresidents Philadelphia uses a requirement of employment test to determine whether Wage Tax withholding is required. This will ensure fewer errors and faster processing. The COVID EZ Request form covers the period from January to August 2021.

But this years refunds still account for much more money than in years past due to the pandemic. Philadelphia resident with taxable income who doesnt have the City Wage Tax withheld from your paycheck. For refund-related inquiries please call 215 686-6574 6575 or.

Real Estate Tax refunds. Get a tax account. Philadelphia City Wage Tax Refund forms are now available on the City of Philadelphia website.

If your company doesnt file en masse you can file for your own refund. Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481. Philadelphia City Wage Tax Refunds FAQs.

2021 Time Worked Outside of Philadelphia. Prior to 2020 to request a refund of wage taxes paid employees had to file and submit a Wage Tax Refund Petition to the city. Petition for a tax appeal.

Individuals who reside outside of the City of Philadelphia and had Philadelphia Wage Tax deducted for days that they were required to work from home may complete the form to request a refund.

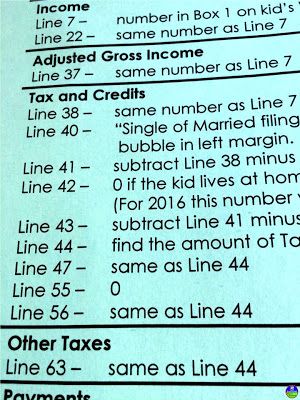

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Financial Literacy Lessons

Ein Tax Id Confirmation Letter Confirmation Letter Doctors Note Template Employer Identification Number

Tax Company Tax Prep Ad Instagram Image Accounting Services Corporate Tax Services

Form 1040 U S Individual Tax Return Definition Tax Forms Irs Tax Forms Income Tax Return

The Irs Telephone Number Is 1 800 829 1040 And Irs Customer Service Representatives Are Available From 7 A M 7 P M Monday Irs Business Tax Tax Questions

How To Figure Out Payroll Deductions Payroll Taxes Tax Deductions Payroll

How To Stop Student Loan Wage Garnishment

Some Are Getting An Unanticipated Coronavirus Stimulus Check However Can They Keep It Https Www Thenewsedge Com 2020 05 Social Security Checks Tax Return

Tax W2 Form Ein Employer Job Income Earned Income Dependent E File Irs Return Customize Personalized Tax Forms W2 Forms Income Tax

Trump Admin Fumbling Medical Equipment Supply Chain Management Rachel Maddow Looks At Report Chain Management Supply Chain Management Emergency Management