child tax credit december 2021 how much

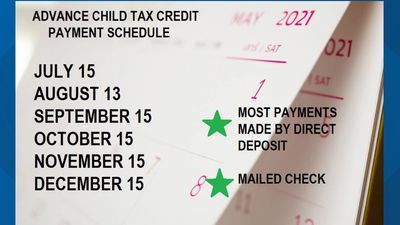

Those who are eligible will receive monthly payments of between 250 and 300 from July 2021 to December 2021 corresponding to half of the total amount of the credit. The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021.

How To Get Up To 3 600 Child Tax Credit Now Michael Ryan Money

How Next Years Credit Could Be Different.

. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. Qualifying children can include a birth child stepchild adopted child or foster child placed by a court.

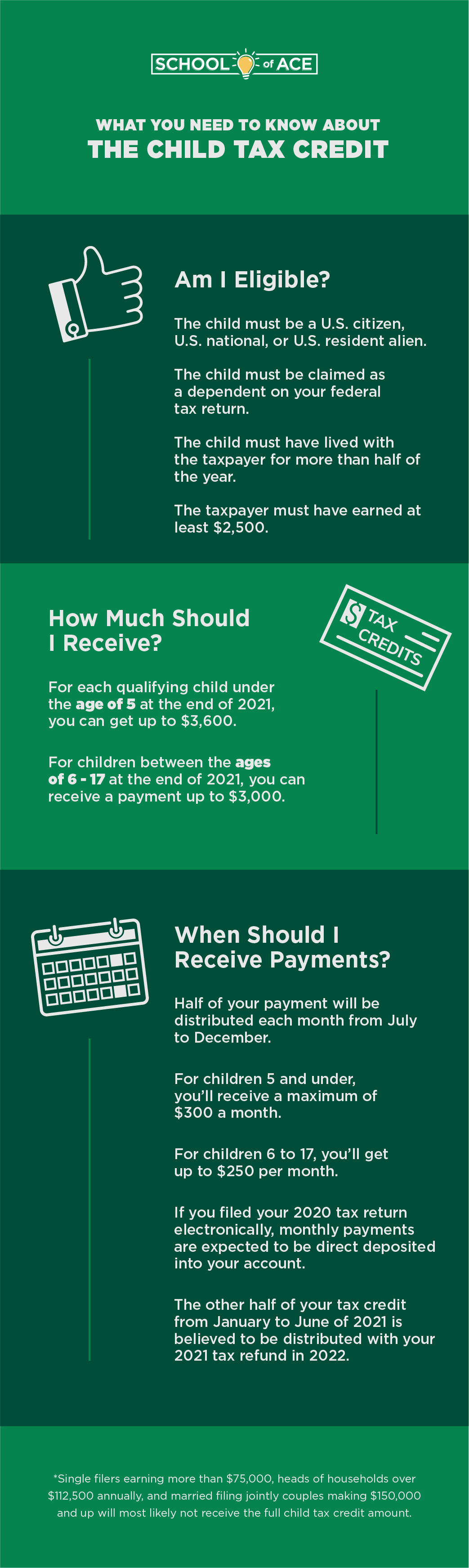

Child Tax Credit 2022. How much money will families have received from Child Tax Credit by December 2021. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased.

Eligible families have received monthly payments of up. It is not clear whether or not the enhanced credit will be extended into 2022. First your child cant be older than 18 by the end of December 2021.

The family would receive 300 per month for the 3-year-old. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in 2021. For 2021 eligible parents or guardians.

To be eligible for the maximum credit taxpayers had to have an AGI of. The Child Tax Credit provides a credit of up to 3600 per child under age 6 and 3000 per child between the ages of 6 and. Like the previous child tax credit the 2021 Child Tax Credit restricts who will qualify for the credit based on adjusted gross income.

There are taxes and family. A childs age determines the amount. The sixth and final advance child tax credit payment of 2021 goes out Dec.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. 3600 for children ages 5 and under at the end of 2021. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17. However if the IRS paid you too much in monthly payments last year ie more than the child tax credit youre entitled to claim for 2021 you might have to pay back some of. The income limits for qualifying for the full tax credit.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. If the modified AGI is above the threshold the credit begins to phase out.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 3600 to 3600 for each. For 2021 the credit phases out in two different steps. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

Have been a US. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. There is a tax credit for children.

The 2021 Child Tax. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. The final payment for the child tax credit will be made on 15 December.

75000 or less for singles. December marks the last month that. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

That means the total advance payment of 4800 9600 x 50 would be sent in monthly installments from July through December. It helped roughly 60 million children and helped cut. 112500 or less for heads of household.

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Update Next Payment Coming On November 15 Marca

Congress Votes To Increase Child Tax Credit Bring More Families Out Of Poverty Youtube

What Is The Child Tax Credit Tax Policy Center

Stimulus Update December Child Tax Credit Payment To Hit Bank Accounts This Week Silive Com

Child Tax Credit Payments December 2021 Will Government Shutdown Affect Sending Of Money Itech Post

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Final Check Child Tax Credit Payment For December Youtube

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

What You Need To Know About The Child Tax Credit

Expanded Child Tax Credit Here Are The New Changes This Year

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month Wgn Tv

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions